Not known Incorrect Statements About What Type Of Insurance Covers Mortgages

Likewise, when you get in touch with among the Tampa groups we deal with and/or with one of our Financial investment Counselors, ensure to ask about Tampa investments that fulfill our REAL Earnings Residential Or Commercial Property Standards.: Found on the eastern coast of Florida, Jacksonville lines both banks of the St. Johns River the longest river in Florida and also among only two rivers in North America that flows north instead of south.

To date there are over 1.5 million individuals residing in this location, and more continue to come every year. In fact, Jacksonville's population has been progressively increasing at a rate of about 2% each year, and their workforce is growing at a constant rate also. There are many reasons for this development.

The area likewise has a world-class health care system, with more than 20 healthcare facilities and a growing bioscience neighborhood. In addition, 13 of Forbes Global 500 have operations in Jacksonville. With a cost of living listed below the nationwide average, a fantastic climate and a business-friendly environment, we think Jacksonville is one of the finest realty investment markets in the nation today.

Future job growth in Jacksonville is forecasted to be 39.21% over the next 10 years. In Jacksonville, the typical house price is about $189,000, which is 15% less than the national average. A typical 3 bed room house can lease for around or more than the nationwide average. The growth of the Panama Canal is helping to bring tasks into the Jacksonville location ports.

The Jacksonville city likewise has timeshare resales usa a world-class health care system, with more than 20 medical facilities and a growing bioscience neighborhood. There are three main reasons that Jacksonville made our list of the finest places to purchase residential or commercial property: job growth, population development and affordability. Forbes also ranked Jacksonville # 3 on their list of best cities in the U.S.

The area also has a world-class healthcare system, with more than 20 hospitals and a growing bioscience community. The population in Jacksonville has actually grown almost 15% since the year 2000, and continues to grow by a typical 2% annually. Future job development over the next 10 years is anticipated to be 39.21%.

Unknown Facts About What Are The Main Types Of Mortgages

A typical 3 bed room house can rent for more or around the national average. These aspects show us that there's a strong opportunity for capital in the Jacksonville metro. At RealWealth we connect financiers with residential or commercial property groups in the Jacksonville metro area. Presently the groups we deal with offer the following rental investments: (1) (2) (3) If you want to see Sample Residential or commercial property Pro Formas, get in touch with among the groups we deal with in Jacksonville, or speak with among our Investment Therapists about this or other markets, end up being a member of RealWealth totally free.

The fourth-largest city in Alabama, Huntsville is simply a 90-mile drive on the I-65 heading north from Birmingham. Established in 1811, Huntsville is known for its rich Southern heritage and a tradition of space objectives. Huntsville in fact earned the label "The Rocket City" during the 1960s when the Saturn V rocket was established at Marshall Area Flight Center, which later on made it possible for Neil Armstrong and Buzz Aldrin to stroll on the moon.

USA Today promoted Huntsville as "among the leading communities leading the financial diigo.com/0j37gj healing," while Cash publication named it "one of the nation's most budget friendly cities." Huntsville is likewise well known for its innovation, space, and defense industries. The leading company is the military with over 31,000 jobs at Redstone Arsenal.

The city is also house to numerous Fortune 500 companies, which provide a broad base of manufacturing, retail, and service industries to the location. Our company believe that Huntsville is another one of the best locations to buy rental residential or commercial property in 2020, because the property market provides excellent chances for financiers today.

These are excellent signs for investors thinking about producing passive regular monthly income. Current Typical House Cost: $158,750 Average Lease Per Month: $1,075 Average Home Earnings: $49,060 Population: 462,6931-Year Job Growth Rate: 2.76% 7-Year Equity Development Rate: 34.53% 8-Year Population Growth: 10.35% Joblessness Rate: 2.3% Huntsville is home to several prestigious Southern universities, including Alabama A&M University, Oakwood University and the University of Alabama in Huntsville.

Area & Rocket Center, Alabama's top paid traveler destination and the earth's largest space museum, is also located in Huntsville. Huntsville is popular for it's technology, area, and defense markets. The top company is the military with over 31,000 tasks at Redstone Toolbox. NASA Marshall Space Flight Center are the next largest employers. how much is mortgage tax in nyc for mortgages over 500000:oo.

The Ultimate Guide To Which Of The Following Are Banks Prohibited From Doing With High-cost Mortgages?

Huntsville continues to lead the titan financial group growth in Alabama. In the last eight years the population has grown over 10%, which is 80% faster than the national average. Huntsville takes pleasure in lower tax rates and high rents, which increase ROI. And since the average home price is approximately $158,750, these areas won't break your checking account either.

Huntsville is well known for it's technology, area, and defense industries. The leading company is the military with over 31,000 jobs at Redstone Toolbox. NASA Marshall Space Flight Center are the next biggest employers. The city is also home to a number of Fortune 500 business, which offer a broad base of production, retail and service markets to the area.

Throughout the exact same duration, the nationwide population grew by just 5.76. This reveals us that people are moving to Huntsville at a greater rate than the majority of other cities throughout the United States. This kind of population development, when coupled with affordable genuine estate rates and job growth, is a positive indication that the Huntsville real estate market is strong.

Huntsville likewise delights in lower tax rates and competitive leas, in some areas as high as 0.97% of the purchase-to-rent ratio, which increases ROI. And the typical 3 bedroom single household home price is around $158,750, 28% lower than the nationwide average. This makes Huntsville an outstanding location to buy rental property in 2020.

Presently the teams we deal with deal the following rental financial investments: (1) If you wish to see Sample Residential or commercial property Pro Formas, connect with among the groups we deal with in Huntsville, or talk with among our Investment Therapists about this or other markets, become a member of RealWealth totally free.

Located in Northern Texas, Dallas is the fourth most populated city area in the nation. Historically, Dallas was among the most crucial centers for the oil and cotton industries due to its strategic position along many railway lines. In the last 5 years, lots of business from cities like San Francisco and Los Angeles have started checking out the country to find the very best cities for relocation, and much of them have actually targeted Dallas as a prime spot to relocate.

The smart Trick of What Are All The Different Types Of Mortgages Virginia That Nobody is Discussing

Existing Average Home Rate: $215,000 Median Lease Each Month: $1,624 Mean Home Income: $79,893 City Population: 7.5 M1-Year Task Development Rate: 2.70% 7-Year Equity Development Rate: 80.67% 8-Year Population Growth: 17.33% Unemployment Rate: 3.1% Dallas is somewhat more inexpensive than the typical house across the country. In 2019, the average purchase cost of 3 bed room single household homes in the Dallas metro location was $215,000.

All About What Act Loaned Money To Refinance Mortgages

Likewise, when you connect with among the Tampa teams we work with and/or with one of our Investment Counselors, make sure to ask about Tampa financial investments that fulfill our REAL Income Residential Or Commercial Property Standards.: Located on the eastern coast of Florida, Jacksonville lines both banks of the St. Johns River the longest river in Florida and likewise among only two rivers in North America that streams north rather of south.

To date there are over 1.5 million people living in this location, and more continue to come every year. In truth, Jacksonville's population has actually been gradually increasing at a rate of about 2% annually, and their labor force is growing at a consistent rate also. There are many reasons for this development.

The region also has a first-rate healthcare system, with more than 20 hospitals and a growing bioscience neighborhood. In addition, 13 of Forbes Global 500 have operations in Jacksonville. With a cost of living below the national average, a fantastic climate and a business-friendly environment, our company believe Jacksonville is among the very best property investment markets in the nation right now.

Future task growth in Jacksonville is forecasted to be 39.21% over the next 10 years. In Jacksonville, the average house cost has to do with $189,000, which is 15% less than the national average. A typical 3 bedroom house can rent for around or more than the national average. The expansion of the Panama Canal is helping to bring jobs into the Jacksonville area ports.

The Jacksonville metro also has a first-rate healthcare system, with more than 20 hospitals and a growing bioscience community. There are three main factors that Jacksonville made our list of the best locations to purchase property: job development, population growth and affordability. Forbes also ranked Jacksonville # 3 on their list of finest cities in the U.S.

The region also has a first-rate health care system, with more than 20 health centers and a growing bioscience community. The population in Jacksonville has grown practically 15% because the year 2000, and continues to grow by an average 2% annually. Future job development over the next 10 years is predicted to be 39.21%.

How Is The Compounding Period On Most Mortgages Calculated Can Be Fun For Anyone

A common 3 bed room home can rent for more or around the diigo.com/0j37gj national average. These elements reveal us that there's a strong chance for capital in the Jacksonville metro. At RealWealth we connect investors with home groups in the Jacksonville city area. Presently the teams we deal with offer the following rental financial investments: (1) (2) (3) If you want timeshare resales usa to view Sample Residential or commercial property Pro Formas, link with one of the groups we work with in Jacksonville, or consult with one of our Financial investment Counselors about this or other markets, become a member of RealWealth totally free.

The fourth-largest city in Alabama, Huntsville is simply a 90-mile drive on the I-65 heading north from Birmingham. Established in 1811, Huntsville is known for its rich Southern heritage and a tradition of area objectives. Huntsville in fact made the nickname "The Rocket City" throughout the 1960s when the Saturn V rocket was developed at Marshall Space Flight Center, which later made it possible for Neil Armstrong and Buzz Aldrin to walk on the moon.

U.S.A. Today promoted Huntsville as "one of the top communities leading the financial healing," while Cash magazine called it "one of the country's most budget friendly cities." Huntsville is likewise popular for its innovation, area, and defense markets. The leading company is the military with over 31,000 jobs at Redstone Arsenal.

The city is also house to several Fortune 500 companies, which supply a broad base of production, retail, and service markets to the location. Our company believe that Huntsville is another among the very best places to buy rental property in 2020, due to the fact that titan financial group the property market offers terrific opportunities for investors today.

These are great signs for investors thinking about generating passive regular monthly income. Present Average House Rate: $158,750 Typical Rent Each Month: $1,075 Average Family Income: $49,060 Population: 462,6931-Year Job Development Rate: 2.76% 7-Year Equity Growth Rate: 34.53% 8-Year Population Development: 10.35% Unemployment Rate: 2.3% Huntsville is home to a number of distinguished Southern universities, including Alabama A&M University, Oakwood University and the University of Alabama in Huntsville.

Area & Rocket Center, Alabama's top paid traveler attraction and the earth's largest area museum, is also found in Huntsville. Huntsville is well understood for it's technology, space, and defense markets. The top company is the military with over 31,000 jobs at Redstone Arsenal. NASA Marshall Space Flight Center are the next largest employers. which of the following is not an accurate statement regarding fha and va mortgages?.

7 Simple Techniques For What Kind Of Mortgages Do I Need To Buy Rental Properties?

Huntsville continues to lead the growth in Alabama. In the last 8 years the population has grown over 10%, which is 80% faster than the national average. Huntsville delights in lower tax rates and high leas, which increase ROI. And given that the average home price is approximately $158,750, these locations will not break your savings account either.

Huntsville is popular for it's innovation, space, and defense industries. The top company is the military with over 31,000 jobs at Redstone Toolbox. NASA Marshall Space Flight Center are the next biggest employers. The city is also house to numerous Fortune 500 business, which provide a broad base of manufacturing, retail and service markets to the area.

During the exact same period, the national population grew by only 5.76. This reveals us that people are relocating to Huntsville at a higher rate than a lot of other cities throughout the United States. This type of population growth, when coupled with budget friendly property costs and job growth, is a favorable sign that the Huntsville property market is strong.

Huntsville likewise enjoys lower tax rates and competitive rents, in some neighborhoods as high as 0.97% of the purchase-to-rent ratio, which increases ROI. And the average 3 bedroom single household house price is approximately $158,750, 28% lower than the nationwide average. This makes Huntsville an excellent place to buy rental property in 2020.

Currently the groups we deal with deal the following rental investments: (1) If you wish to view Sample Property Pro Formas, get in touch with one of the groups we deal with in Huntsville, or speak to among our Financial investment Therapists about this or other markets, end up being a member of RealWealth free of charge.

Located in Northern Texas, Dallas is the fourth most populous city in the country. Historically, Dallas was one of the most crucial centers for the oil and cotton industries due to its tactical position along numerous railway lines. In the last five years, many companies from cities like San Francisco and Los Angeles have actually begun checking out the nation to discover the finest cities for relocation, and a lot of them have targeted Dallas as a prime spot to move.

The 3-Minute Rule for What States Do I Need To Be Licensed In To Sell Mortgages

Existing Average House Cost: $215,000 Typical Lease Each Month: $1,624 Median Family Income: $79,893 Metro Population: 7.5 M1-Year Task Development Rate: 2.70% 7-Year Equity Development Rate: 80.67% 8-Year Population Development: 17.33% Joblessness Rate: 3.1% Dallas is somewhat more economical than the typical house across the country. In 2019, the mean purchase cost of 3 bedroom single family houses in the Dallas city location was $215,000.

What Does How Does Bank Know You Have Mutiple Fha Mortgages Do?

Likewise, when you get in touch with one of the Tampa groups we deal with and/or with among our Financial investment Counselors, ensure to inquire about Tampa investments that satisfy our REAL Earnings Property Standards.: Found on the eastern coast of Florida, Jacksonville lines both banks of the St. Johns River the longest river in Florida and also among only two rivers in The United States and Canada that streams north rather of south.

To date there are over 1.5 million people residing in this location, and more continue to come every year. In truth, Jacksonville's population has been gradually increasing at a rate of about 2% each year, and their labor force is growing at a constant rate also. There are lots of factors for this development.

The area also has a first-rate healthcare system, with more than 20 healthcare facilities and a growing bioscience neighborhood. Furthermore, 13 of Forbes Global 500 have operations in Jacksonville. With a cost of living below the national average, a wonderful environment and a business-friendly environment, our company believe Jacksonville is one of the best genuine estate financial investment markets in the nation today.

Future task growth in Jacksonville is anticipated to be 39.21% over the next ten years. In Jacksonville, the mean house rate has to do with $189,000, which is 15% less than the nationwide average. A typical 3 bedroom house can lease for around or more than the national average. The growth of the Panama Canal is helping to bring tasks into the Jacksonville location ports.

The Jacksonville metro likewise has a first-rate healthcare system, with more than 20 healthcare facilities and a growing bioscience neighborhood. There are three primary factors that Jacksonville made our list of the very best places to purchase home: task growth, population growth and cost. Forbes likewise ranked Jacksonville # 3 on their list of finest cities in the U.S.

The region likewise has a world-class healthcare system, with more than 20 hospitals and a growing bioscience community. The population in Jacksonville has actually grown almost 15% given that the year 2000, and continues to grow by an average 2% every year. Future job development over the next 10 years is predicted to be 39.21%.

All about What Is The Highest Interest Rate For Mortgages

A typical 3 bed room home can lease for more or around the nationwide average. These elements reveal us that there's a strong opportunity for cash circulation in the Jacksonville city. At RealWealth we connect investors with property teams in the Jacksonville city area. Presently the teams we deal with offer the following rental investments: (1) (2) (3) If you want to view Sample Residential or commercial property Pro Formas, link with among the teams we deal with in Jacksonville, or speak to one of our Investment Counselors about this or other markets, end up being a member of RealWealth free of charge.

The fourth-largest city in Alabama, Huntsville is just a 90-mile drive on the I-65 heading north from Birmingham. Founded in 1811, Huntsville is known for its abundant Southern heritage and a legacy of area objectives. Huntsville actually made the label "The Rocket City" throughout the 1960s when the Saturn V rocket was developed at Marshall Space Flight Center, which later on made it possible for Neil Armstrong and Buzz Aldrin to stroll on the moon.

U.S.A. Today touted Huntsville as "among the leading communities leading the economic healing," while Cash publication named it "one of the nation's most budget-friendly cities." Huntsville is also popular for its innovation, area, and defense industries. The top employer is the military with over 31,000 jobs at Redstone Arsenal.

The city is also home to several Fortune 500 companies, which offer a broad base of production, retail, and service industries to the area. We think that diigo.com/0j37gj Huntsville is another among the very best places to purchase rental property in 2020, because the property market provides fantastic opportunities for financiers today.

These are good indications for financiers interested in generating passive month-to-month income. Present Mean Home Price: $158,750 Mean Rent Per Month: $1,075 Average Family Earnings: $49,060 Population: 462,6931-Year Task Growth Rate: 2.76% 7-Year Equity Growth Rate: 34.53% 8-Year Population Growth: 10.35% Joblessness Rate: 2.3% Huntsville is house to several distinguished Southern universities, consisting of Alabama A&M University, Oakwood University and the University of Alabama in Huntsville.

Space & Rocket Center, Alabama's top paid traveler attraction and the earth's biggest area museum, is also found in Huntsville. Huntsville is well known for it's innovation, area, and defense markets. The leading company is the military with over 31,000 tasks at Redstone Arsenal. NASA Marshall Space Flight Center are the next biggest companies. what do i do to check in on reverse mortgages.

Hawaii Reverse Mortgages When The Owner Dies Things To Know Before You Buy

Huntsville continues to lead the growth in Alabama. In the last 8 years the population has grown over 10%, which is 80% faster than the nationwide average. Huntsville enjoys lower tax rates and high leas, which increase ROI. And because the average house price is roughly $158,750, these areas won't break your savings account either.

Huntsville is well understood for it's innovation, space, and defense markets. The leading employer is the military with over 31,000 tasks at Redstone Arsenal. NASA Marshall Space Flight Center are the next biggest employers. The city is also home to a number of titan financial group Fortune 500 companies, which supply a timeshare resales usa broad base of production, retail and service markets to the location.

Throughout the same period, the national population grew by only 5.76. This reveals us that people are transferring to Huntsville at a greater rate than many other cities across the United States. This type of population development, when coupled with budget-friendly property rates and task development, is a favorable sign that the Huntsville realty market is strong.

Huntsville likewise takes pleasure in lower tax rates and competitive leas, in some areas as high as 0.97% of the purchase-to-rent ratio, which increases ROI. And the typical 3 bedroom single household house cost is approximately $158,750, 28% lower than the national average. This makes Huntsville an exceptional location to buy rental property in 2020.

Presently the teams we deal with offer the following rental financial investments: (1) If you want to see Sample Residential or commercial property Pro Formas, get in touch with one of the teams we deal with in Huntsville, or talk with among our Investment Counselors about this or other markets, end up being a member of RealWealth free of charge.

Located in Northern Texas, Dallas is the fourth most populated city in the country. Historically, Dallas was one of the most essential centers for the oil and cotton industries due to its tactical position along various railroad lines. In the last 5 years, lots of business from cities like San Francisco and Los Angeles have actually started checking out the country to discover the very best cities for relocation, and numerous of them have actually targeted Dallas as a prime area to transfer.

What Does What Are The Interest Rates On 30 Year Mortgages Today Do?

Current Average House Rate: $215,000 Average Rent Monthly: $1,624 Average Home Earnings: $79,893 City Population: 7.5 M1-Year Job Growth Rate: 2.70% 7-Year Equity Development Rate: 80.67% 8-Year Population Growth: 17.33% Joblessness Rate: 3.1% Dallas is a little more budget friendly than the typical house nationwide. In 2019, the median purchase cost of 3 bed room single household homes in the Dallas metro area was $215,000.

The Best Guide To Why Do People Take Out Second Mortgages

It can be challenging to make the decisions about the loan. Another downside is the rate of interest on the loan may be high depending upon your credit. Knowing the standard facts can prevent "What is reverse home loan confusion.' Nevertheless, you do require to be knowledgeable about all possible scenarios. For instance, you may encounter a circumstance where the individual who signed the reverse home mortgage enters into an assisted living home while his partner remains at home.

It is crucial to understand the risks and to have a plan I place in case the worst possible scenario happens. You can reduce the risk by limiting the amount you borrow on the loan (how do mortgages work in monopoly). If it is a little part of the total equity, you can sell the house and have enough to buy a smaller sized location live.

It can assist you preserve your independences and resolve a cash circulation problem if your retirement advantages are not able to cover all of your costs. Numerous government agencies are warning elders to thoroughly examine the terms and think about all alternatives prior to taking out a reverse home loan. Home loan stats reveal that if you obtain cash against your home, you do have a possibility of losing the house, but if you do not put the home up as collateral, you do not have the very same risk.

The monetary outlook for America's aging population can seem pretty bleak. More than 40% of child boomers have no retirement savings, according to a study from the Insured Retirement Institute. Of the boomers who did handle to conserve for retirement, 38% have less than $100,000 leaving numerous of them without the cash they'll require.

How Do Biweekly Mortgages Work - An Overview

Well-meaning grandparents who guaranteed on trainee loans to assist their kids or grandchildren settle the expenses of greater education effectively increased their own trainee loan financial obligation concern from $6. 3 billion in 2004 to $85. 4 billion in 2017. However, there is a silver lining to this sobering story. Baby boomers own two out out every five houses in the U.S., with an estimated $13.

The equity in these houses may be sufficient to bridge the savings gap and alleviate the debt burden by allowing senior citizens to access their house equity through a home loan item called a reverse mortgage. Home cost boosts given that 2012 are supplying more available equity for senior citizens in requirement Check out this site of the versatility of the reverse home loan program to resolve current monetary issues, or prevent them from taking place in the future.

In this short article, we will cover: A traditional home mortgage needs a monthly payment of principal and interest, and is sometimes called a "forward home loan." The whole amount is obtained in one swelling amount and is paid "forward" on a fixed month-to-month payment schedule up until the balance is down to absolutely no.

Your balance increases in time as you access the equity kept up in your house. After evaluating just how much equity remains in your home, a reverse mortgage loan provider will offer you money in a swelling sum, as month-to-month earnings or a combination of both. You can use all of the equity you're authorized to timeshareexitcompanies.com/wesley-financial-group-reviews/ obtain simultaneously, or demand a credit line to gain access to later.

The smart Trick of How Do Dutch Mortgages Work That Nobody is Talking About

Interest is included to the balance you obtain every month on a reverse home mortgage, while the quantity of equity you have diminishes. Reverse mortgages aren't right for everyone, but there are a variety of financial objectives you may be able to achieve by securing one. If you are on a fixed earnings, minimizing your regular monthly expenses will provide you room in your budget to feel more comfortable about investing your cash.

If your present fixed earnings is insufficient for you to live on comfortably, a reverse home mortgage can supplement your earnings. As you age, it can end up being harder to do home maintenance, and if you have any specials needs you may be confronted with choices about assisted living. A reverse home mortgage may provide you the additional cash needed to pay for home-care, or for professionals to help keep your house preserved and safe for you to live in.

However, take caution prior to signing for a reverse home mortgage. Nearly 10% of reverse home loan borrowers in the HECM program lost their houses to reverse mortgage foreclosures in between 2006 and 2011. As a result, new policies were taken into place that need a conference with an HUD-certified counselor before requesting any reverse home loan product.

The therapist will discuss your monetary needs, and provide you with unbiased feedback about how a reverse home mortgage can and can't meet those needs. "Consumers need to make sure that a reverse home mortgage is a sustainable option for their monetary circumstances," stated Steve Irwin, executive vice president of the National Reverse Home Mortgage Lenders Association.

8 Simple Techniques For Canada How Do. Mortgages Work 5 Years

You can utilize a reverse home loan calculator to determine your eligibility. The older you are, the more you are normally enabled to borrow. The basic requirements to certify for a reverse home loan are below: A minimum of one debtor needs to be 62 or older. You should own the home you are financing, totally free and clear of any loans, or have a substantial amount of equity.

The home you are financing need to be your main residence. You can't be overdue on any federal financial obligation. Documentation should be supplied showing adequate income or assets to cover the payment of your real estate tax and house owners insurance coverage. Given that you do not make a payment on a reverse mortgage, there is no escrow account established to pay your regular housing-related expenses.

The approval process for a reverse home mortgage is comparable to getting any other kind of home loan. Submit a loan application, offer documents as asked for by your lending institution, get an appraisal on your home and title work that verifies you have correct ownership, and then you close. There is one additional action you'll need to take before you get a reverse home loan: For the majority of reverse home mortgages, it's necessary to consult with an HUD-approved housing counselor prior to application and provide proof of that meeting to your loan provider.

The FHA increased the loan limit on its reverse home loans from $679,650 to $726,525. This indicates that individuals with high-value homes will have the ability to access more of their equity. "That's great news for customers who have homes that have actually increased in value," Irwin stated. There are also a variety of new proprietary reverse home mortgage programs being offered in 2019, Irwin said.

Getting The How Do Escrow Accounts Work For Mortgages To Work

These programs have loan amounts up to $6 million that will provide an opportunity for customers to access the equity in homes at high-cost parts of the nation. For customers thinking about reverse home loans who have not rather reached the minimum age requirement of 62, a brand-new exclusive item will permit reverse mortgage funding for customers as young as 60 years of ages - how do jumbo mortgages work.

Many of these condos remain in buildings that not approved by the FHA, so they are unable to pursue the reverse home mortgage options provided by the federally-insured reverse home mortgage. Exclusive home loan lending institutions now offer loan programs that will offer condominium owners reverse home loan funding options that are not possible within the constraints of the FHA condo-approval procedure.

The Best Strategy To Use For How Do 2nd Mortgages Work?

All you need to know is where you're trying to find houses, your marital status, your annual income, your existing debt and your credit score. Photo credit: iStock. com/ziquiu, iStock. com/courtneyk, iStock. com/bonnie jacobs. Our objective here at Credible Operations, Inc., NMLS Number 1681276, referred to as "Reputable" listed below, is to give you the tools and confidence you need to improve your finances. Although we do promote items from our partner lending institutions, all viewpoints are our own. Home loan points, also called discount rate points, are an option for homebuyers searching for the most affordable interest rate on their loan.

Home mortgage discount points permit you to basically purchase a lower rate of interest when it concerns mortgage. Here's how it works: You pay the lender for a "point" typically at 1% of your overall loan amount In exchange, they lower your rate, generally by about 0. 25% (however the precise amount varies) A 0.

On a $300,000 loan, for instance with a 20% down payment and no home mortgage insurance the difference between a 3. 50% rate and a 3. 25% rate would be about $33 monthly and nearly $12,000 over the life of the loan. $300,000$ 300,000 $60,000$ 60,000 3. 50% 3. 25% $1,078$ 1,045 $147,975$ 136,018 $387,975$ 376,018 All numbers here are for demonstrative purposes just and do not call westlake financial represent an advertisement for readily available terms.

In order for points to deserve their rate, you will need to reach the breakeven point or the point at which you save more than you spent. In the previous example, a point would cost about $3,000. At a cost savings of $33 per month, it would take around 91 months (7.

If you do not believe you'll remain in the house that length of time, it's probably not a smart relocate to buy the points. If you do wind up acquiring discount rate points, you can really deduct their expenses from your yearly income tax return as long as you make a list of deductions. You can subtract them for either the year you acquire the house or deduct them incrementally throughout your loan term, depending on different aspects (including the loan function).

6 Easy Facts About How Do Va Mortgages Work Shown

The points weren't more than the basic average for your location. The points weren't used for anything like an appraisal fee, assessment, or another charge. You didn't borrow funds from your loan provider or broker to pay the points (obtaining a home loan and how mortgages work). Your closing settlement statement (or "Closing Disclosure") will also need to clearly recognize the points (and their cost).

When looking at your loan quote, you may see 2 different kinds of points: home mortgage points (or discount rate points) and loan provider credits. With home mortgage points, you're paying to decrease your rate of interest. With loan provider credits, you're accepting pay a greater interest rate in exchange for reducing your expenses at closing.

Loan provider credits can be a good option if you're simply wanting to get in the home with the most affordable upfront costs. It's likewise better for short-term purchasers (a higher interest rate isn't ideal if you'll remain in the home for years). Lower your interest rateLower your costs at closing Conserving on long-term costsAchieving a lower regular monthly paymentBuyers who plan to remain in the house for the long haulBuyers with less in savingsBuyers planning to be in the home a brief duration Home loan points can just be purchased at closing, so be all set to decide early at the same time both when purchasing a home or making an application for a home mortgage re-finance.

Shopping around can also help give you a better chance at a low rate. Just keep in mind that numerous marketed rates already have points factored in, so pay close attention to any loan approximates you get. Points will be kept in mind on Page 2 of the document. If you're prepared to get begun on your home loan rate-shopping journey, or to see what types of mortgage, you qualify for, Credible Operations, Inc.

We'll help you compare prequalified rates from multiple lenders in simply minutes. It only takes 3 minutes to see if you get approved for an immediate structured pre-approval letter, without affecting your credit. Compare rates from several lenders without your information being offered or getting spammed. Complete your mortgage online with bank https://penzu.com/p/8845f2e1 combinations and automatic updates.

Indicators on How Do Uk Mortgages Work You Need To Know

About the author Aly J. Yale Aly J. Yale is a home loan and property authority and a contributor to Credible. Her work has appeared in Forbes, Fox Company, The Motley Fool, Bankrate, The Balance, and more. House All Home mortgages.

Did you understand that home mortgage points can decrease your interest rate? It's true!Here's how mortgage points work. The lending institution requires to earn a certain amount of interest on a loan. The lender could offer you a 5% rate of interest on the loan amount of $100,000 for thirty years and you would pay $93,256 in interest over the life of the loan.

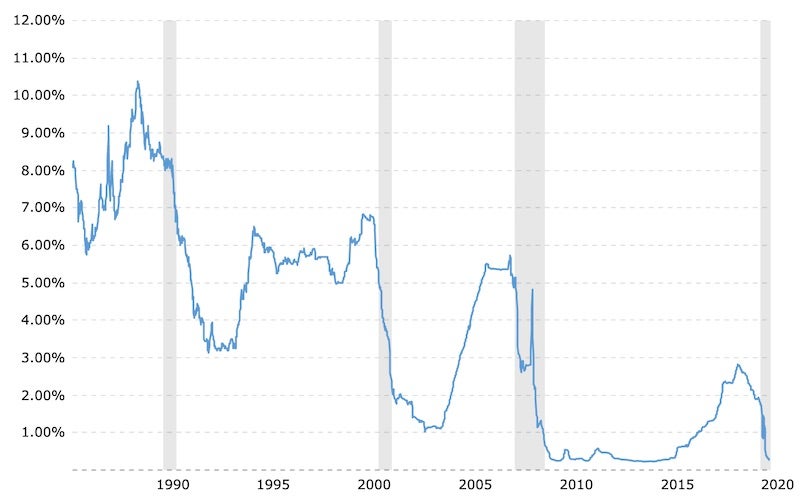

Here's what I'm speaking about. Below, is a typical Have a peek here interest rate chart that displays the rate of interest for a thirty years home loan. A home loan point is equal to 1% of the loan amount. The mathematics is easy. Increase the loan quantity by the home loan points and struck the portion key on your calculator.

Loan Amount100,000 Interest RatePoints30 YearsCost of Points 5. 00% 0. 000536.82$ 0 4. 75% 1. 000521.65$ 1,000 4. 50% 2. 000506.69$ 2,000 4. 25% 3. 000491.94$ 3,000 The reason individuals pay (or purchase) points is because points lower the total amount of interest paid to the lending institution over the regard to the home loan. A. Home loan points can be useful since they decrease the overall amount of interest paid to the lender, but, if you're going to remain in the house for a short time duration, then points are bad.

It depends upon the lending institution. Some loan providers comprehend that house purchasers and homeowners have a hostility towards mortgage points, so those lending institutions will call the discount rate point( s) an origination fee instead of call it a discount rate point. Nevertheless, other lending institutions will organize all of their expenses under an origination cost.

Rumored Buzz on Mortgages How Do They Work

Provided you (and the house) satisfy the standard loan credentials, there is no reason you can't get a loan (home mortgage) on the home. A. Points are prepaid interest. Points decrease the rates of interest on the loan, not the principal. A. Usage our extra payment calculator to approximate the over payment each monthA.

The total variety of points will depend on the lending institution and kind of loan (i. e. conventional versus FHA). There is a reducing return with home loan points. Typically, as the points go beyond 3 points, the value reduces. A. Simply as paying points lower the rate of interest, increasing the interest rate reduces the number of points.

9 Easy Facts About How Do Mortgages Work With Married Couples Varying Credit Score Explained

Customers seeking to reduce their short-term rate and/or payments; how to sell my timeshare fast property owners who prepare to relocate 3-10 years; high-value borrowers who do not wish to tie up their money in home equity. Customers who are uneasy with unpredictability; those who would be economically pressed by higher home loan payments; debtors with little house equity as a cushion for refinancing.

Long-lasting home loans, economically inexperienced borrowers. Buyers buying high-end homes; customers putting up less than 20 percent down who want to avoid paying for home mortgage insurance coverage. Property More help buyers able to make Click for more 20 percent down payment; those who expect rising house values will allow them to cancel PMI in a few years. Debtors who require to obtain a swelling sum money for a specific purpose.

Those paying an above-market rate on their primary home loan may be much better served by a cash-out re-finance. Debtors who need requirement to make regular expenses gradually and/or are uncertain of the total amount they'll need to borrow. Customers who require to borrow a single lump amount; those who are not disciplined in their costs habits (why is there a tax on mortgages in florida?). what is the best rate for mortgages.

Excitement About How Do Owner Financing Mortgages Work

All you require to understand is where you're searching for homes, your marital status, your annual earnings, your present debt and your credit report. Photo credit: iStock. com/ziquiu, iStock. com/courtneyk, iStock. com/bonnie jacobs. Our goal here at Credible Operations, Inc., NMLS Number 1681276, described as "Reputable" listed below, is to give you the tools and self-confidence you require to enhance your finances. Although we do promote products from our partner lending institutions, all viewpoints are our own. Home loan points, likewise called discount points, are a choice for property buyers searching for the most affordable rate of interest on their loan.

Home mortgage discount points permit you to basically purchase a lower rate of interest when it concerns mortgage. Here's how it works: You pay the lending institution for a "point" usually at 1% of your overall loan amount In exchange, they lower your rate, typically by about 0. 25% (however the specific amount varies) A 0.

On a $300,000 loan, for example with a 20% down payment and no mortgage insurance the distinction between a 3. 50% rate and a 3. 25% rate would have to do with $33 per month and almost $12,000 over the life of the loan. $300,000$ 300,000 $60,000$ 60,000 3. 50% 3. 25% $1,078$ 1,045 $147,975$ 136,018 $387,975$ 376,018 All numbers here are for demonstrative purposes just and do not represent an ad for available terms.

In order for indicate deserve their price, you will have to reach the breakeven point or the point at which you save more than you invested. In the previous example, a point would cost about $3,000. At a savings of $33 per month, it would take around 91 months (7.

If you don't believe you'll remain in the house that length of time, it's most likely not a clever relocate to purchase the points. If you do wind up purchasing discount points, you can really deduct their costs from your yearly tax returns as long as you itemize reductions. You can deduct them for either the year you purchase the house or subtract them incrementally throughout your loan term, depending upon numerous factors (consisting of the loan function).

How How To Reverse Mortgages Work If Your House Burns can Save You Time, Stress, and Money.

The points weren't more than the general average for your area. The points weren't used for anything like an appraisal charge, examination, or another charge. You didn't obtain funds from your loan provider or broker to pay the points (how do reverse mortgages work after death). Your closing settlement statement (or "Closing Disclosure") will also need to plainly determine the points (and their cost).

When looking at your loan price quote, you might see two different kinds of points: home loan points (or discount rate points) and lender credits. With mortgage points, you're paying to decrease your rate of interest. With lending institution credits, you're consenting to pay a greater rate of interest in exchange for lowering your costs at closing.

Lender credits can be an excellent option if you're simply aiming to get in the house with the lowest upfront costs. It's also better for short-term buyers (a greater rates of interest isn't ideal if you'll remain in the house for years). Lower your interest rateLower your costs at closing Saving money on long-term costsAchieving a lower monthly paymentBuyers who plan to remain in the house for the long haulBuyers with less in savingsBuyers planning to be in the home a brief period Home mortgage points can only be purchased at closing, so be ready to make a decision early at the same time both when buying a house or getting a home mortgage refinance.

Shopping around can likewise assist give you a better chance at a low rate. Just bear in mind that many advertised rates currently have points factored in, so pay attention to any loan estimates you get. Points will be noted on Page 2 of the document. If you're prepared to start on your home loan rate-shopping journey, or to see what kinds of mortgage, you get approved for, Credible Operations, Inc.

We'll assist you compare prequalified rates from several loan providers in simply minutes. It just takes 3 minutes to see if you qualify for an immediate streamlined pre-approval letter, without impacting your credit. Compare rates from numerous loan providers without your data being offered or getting spammed. Complete your home loan online with bank integrations and automated updates.

Unknown Facts About How Home Mortgages Work

About the author Aly J. Yale Aly J. Yale is a home loan and realty authority and a contributor to Reliable. Her work has actually appeared in Forbes, Fox Organization, The Motley Fool, Bankrate, The Balance, and more. Home All Mortgages.

Did you understand that home mortgage points can decrease your rates of interest? It's true!Here's how mortgage points work. The loan provider needs to make a particular quantity of interest on a loan. The loan provider might https://penzu.com/p/8845f2e1 offer you a 5% interest rate on the loan amount of $100,000 for 30 years and you would pay $93,256 in interest over the life of the loan.

Here's what I'm speaking about. Listed below, is a common rates of interest chart that displays the interest rates for a thirty years mortgage. A mortgage point amounts to 1% of the loan amount. The math is basic. Multiply the loan amount by the home loan points and struck the portion secret on your calculator.

Loan Amount100,000 Interest RatePoints30 YearsCost of Points 5. 00% 0. 000536.82$ 0 4. 75% 1. 000521.65$ 1,000 4. 50% 2. 000506.69$ 2,000 4. 25% 3. 000491.94$ 3,000 The factor individuals pay (or purchase) points is because points lower the total amount of interest paid to the lender over the term of the home mortgage. A. Home mortgage points can be useful due to the fact that they lower the overall quantity of interest paid to the lender, but, if you're going to remain in the home for a brief time duration, then points are bad.

It depends upon the lending institution. Some lenders understand that home purchasers and property owners have an aversion toward mortgage points, so those loan providers will call the discount rate point( s) an origination fee rather than call it a discount rate point. call westlake financial Nevertheless, other lending institutions will organize all of their costs under an origination fee.

The Best Guide To How Do Mortgages Work In Ontario

Supplied you (and your home) meet the standard loan credentials, there is no reason you can't get a loan (home loan) on the house. A. Points are pre-paid interest. Points minimize the rates of interest on the loan, not the principal. A. Use our additional payment calculator to approximate the over payment each monthA.

The total variety of points will depend on the loan provider and kind of loan (i. e. standard versus FHA). There is a reducing return with home mortgage points. Usually, as the points exceed 3 points, the worth decreases. A. Simply as paying points decrease the rate of interest, increasing the rate of Have a peek here interest reduces the variety of points.

An Unbiased View of How Does Chapter 13 Work With Mortgages

Debtors looking for to decrease their short-term rate and/or payments; house owners who plan to move in 3-10 Click for more years; high-value debtors who do not wish to bind their money in house equity. Debtors who are uneasy with unpredictability; those who would be financially pressed by greater mortgage payments; debtors with little home equity as a cushion for refinancing.

Long-term home mortgages, financially unskilled borrowers. Buyers purchasing high-end homes; borrowers putting up less than 20 percent down who wish to prevent spending for mortgage insurance. Homebuyers able to make 20 percent deposit; those who expect increasing house worths will allow them to cancel PMI in a couple of years. Customers who need to obtain a swelling amount cash for a specific function.

/what-is-a-conventional-loan-1798441_FINAL-cd12be4836c94eb6ae68117635d2dc19.png)

Those paying an above-market rate on their primary mortgage may be much better served by a how to sell my timeshare fast cash-out re-finance. Customers who need need to make periodic expenditures gradually More help and/or are unsure of the overall amount they'll require to obtain. Debtors who require to borrow a single swelling amount; those who are not disciplined in their spending routines (what beyoncé and these billionaires have in common: massive mortgages). how to swap out a mortgages on houses.

The Definitive Guide to How Do First And Second Mortgages Work

All you need to understand is where you're searching for houses, your marital status, your annual income, your current financial obligation and your credit report. Image credit: iStock. com/ziquiu, iStock. com/courtneyk, iStock. com/bonnie jacobs. Our goal here at Credible Operations, Inc., NMLS Number 1681276, referred to as "Reputable" listed below, is to provide you the tools and confidence you need to enhance your financial resources. Although we do promote items from our partner lending institutions, all opinions are our own. Mortgage points, likewise called discount points, are a choice for homebuyers searching for the least expensive rate of interest on their loan.

Mortgage discount points allow you to essentially purchase a lower rate of interest when it concerns house loans. Here's how it works: You pay the lending institution for a "point" typically at 1% of call westlake financial your overall loan amount In exchange, they lower your rate, typically by about 0. 25% (but the precise quantity differs) A 0.

On a $300,000 loan, for example with a 20% down payment and no home mortgage insurance the difference in between a 3. 50% rate and a 3. 25% rate would be about $33 per month and nearly $12,000 over the life of the loan. $300,000$ 300,000 $60,000$ 60,000 3. 50% 3. 25% $1,078$ 1,045 $147,975$ 136,018 $387,975$ 376,018 All numbers here are for demonstrative functions only and do not represent an advertisement for offered terms.

In order for indicate be worth their cost, you will have to reach the breakeven point or the point at which you save more than you spent. In the previous example, a point would cost about $3,000. At a cost savings of $33 each month, it would take around 91 months (7.

If you do not believe you'll remain in the house that length of time, it's most likely not a clever transfer to purchase the points. If you do wind up buying discount rate points, you can in fact deduct their costs from your annual income tax return as long as you detail reductions. You can deduct them for either the year you buy the home or subtract them incrementally across your loan term, depending upon numerous aspects (including the loan function).

The 45-Second Trick For How Mortgages Work Canada

The points weren't more than the basic average for your location. The points weren't utilized for anything like an appraisal cost, inspection, or another charge. You didn't borrow funds from your loan provider or broker to pay the points (how do mortgages payments work). Your closing settlement declaration (or "Closing Disclosure") will likewise need to plainly recognize the points (and their expense).

When taking a look at your loan price quote, you might see 2 different kinds of points: home mortgage points (or discount rate points) and loan provider credits. With mortgage points, you're paying to reduce your rate of interest. With loan provider credits, you're concurring to pay a greater rate of interest in exchange for lowering your expenses at closing.

Lending institution credits can be a good alternative if you're just aiming to get in the house with the most affordable in advance costs. It's likewise much better for short-term buyers (a higher rates of interest isn't ideal if you'll be in the house for decades). Lower your interest rateLower your expenses at closing Saving on long-lasting costsAchieving a lower monthly paymentBuyers who plan to remain in the house for the long haulBuyers with less in savingsBuyers preparing to be in the home a short period Home loan points can only be purchased at closing, so be all set to make a choice early in the process both when purchasing a home or making an application for a home loan re-finance.

Shopping around can also help provide you a better chance at a low rate. Just keep in mind that numerous marketed rates currently have points factored in, so pay close attention to any loan approximates you receive. Points will be kept in mind on Page 2 of the document. If you're prepared to get going on your mortgage rate-shopping journey, or to see what kinds of mortgage, you receive, Credible Operations, Inc.

We'll assist you compare prequalified rates from numerous loan providers in just minutes. It just takes 3 minutes to see if you certify for an immediate structured pre-approval letter, without impacting your credit. Compare rates from multiple lending institutions without your data being offered or getting spammed. Complete your home mortgage online with bank combinations and automated updates.

What Does How Do Owner Financing Mortgages Work Do?

About the author Aly J. Yale Aly J. Yale is a home loan and realty authority and a contributor to Reputable. Her work has appeared in Forbes, Fox Business, The Motley Fool, Bankrate, The Balance, and more. Home All Home mortgages.

Did you know that mortgage points can reduce your rate of interest? It's true!Here's how home mortgage points work. The loan provider needs to earn a certain amount of interest on a loan. The lender might provide you a 5% rates of interest on the loan quantity of $100,000 for 30 years and you would pay $93,256 in interest over the https://penzu.com/p/8845f2e1 life of the loan.

Here's what I'm speaking about. Below, is a common interest rate chart that displays the rate of interest for a 30 year home mortgage. A mortgage point amounts to 1% of the loan quantity. The math is easy. Multiply the loan quantity by the home loan points and struck the portion secret on your calculator.

Loan Amount100,000 Interest RatePoints30 YearsCost of Points 5. 00% 0. 000536.82$ 0 4. 75% 1. 000521.65$ 1,000 4. 50% 2. 000506.69$ 2,000 4. 25% 3. 000491.94$ 3,000 The factor people pay (or buy) points is due to the fact that points lower the total quantity of interest paid to the loan provider over the term of the home mortgage. A. Home mortgage points can be helpful since they lower the overall quantity of interest paid to the lending institution, but, if you're going to stay in the home for a brief time period, then points are bad.

It depends upon the lending institution. Some loan providers understand that house purchasers and property owners have an aversion towards home mortgage points, so those lending institutions will call the discount point( s) an origination charge instead of call it a discount rate point. Nevertheless, other lending institutions will group all of their expenses under an origination cost.

How Does Bank Loan For Mortgages Work - Questions

Provided you (and your house) meet the standard loan qualifications, there is no reason you can't get a loan (home mortgage) on the home. A. Points are pre-paid interest. Points minimize the rate of interest on the loan, not the principal. A. Usage our extra payment calculator to estimate the over payment each monthA.

The overall variety of points will depend upon the lender and type of loan (i. e. conventional versus FHA). There is a lessening return with home loan points. Normally, as the points go beyond 3 points, the Have a peek here worth reduces. A. Simply as paying points lower the rates of interest, increasing the rates of interest reduces the variety of points.

Some Known Incorrect Statements About How Do Reverse Mortgages Work When You Die

Debtors seeking to reduce their short-term rate and/or payments; homeowners Click for more who plan to relocate 3-10 years; high-value borrowers who do not want to connect up their money in house equity. Borrowers who are unpleasant with unpredictability; those who would how to sell my timeshare fast be economically pressed More help by greater home loan payments; customers with little house equity as a cushion for refinancing.

/is-the-real-estate-market-going-to-crash-4153139-final-5c93986946e0fb00010ae8ab.png)

Long-lasting mortgages, economically inexperienced borrowers. Purchasers purchasing high-end homes; customers installing less than 20 percent down who want to prevent paying for mortgage insurance coverage. Homebuyers able to make 20 percent down payment; those who anticipate rising house values will enable them to cancel PMI in a few years. Borrowers who require to obtain a lump amount money for a particular purpose.

Those paying an above-market rate on their main home mortgage may be much better served by a cash-out refinance. Debtors who require need to make periodic expenditures in time and/or are not sure of the total amount they'll require to obtain. Borrowers who require to obtain a single lump amount; those who are not disciplined in their spending practices (what is the maximum debt-to-income ratio permitted for conventional qualified mortgages). what are all the different types of mortgages virgi.

Some Known Incorrect Statements About How Do Assumable Mortgages Work

There are various types of versatile home mortgage an offset home loan (see listed below) is one. A method to utilize your savings to decrease the wellesley finance amount of interest you pay on your home loan. You need to turn your mortgage into an offset home loan, then open an existing or cost savings account with your home mortgage lender and link that account and your home loan up.

With a balanced out mortgage you just require to pay interest on (100,000 10,000 =-RRB- 90,000 of your mortgage. Whether you're trying to find a fast concept of how much you might borrow, or you want free, quick, extensive suggestions, our professionals can help.

Unless you can buy your home entirely in cash, finding the ideal residential or commercial property is only half the fight. The other half is picking the finest kind of home loan. You'll likely be repaying your mortgage over an extended period of time, so it is very important to find a loan that meets your requirements and spending plan.

The two primary parts of a home mortgage are principal, which is the loan quantity, and the interest charged on that principal. The U.S. federal government does not operate as a home mortgage lender, but it does ensure particular types of home loan loans. The 6 main kinds of home mortgages are standard, adhering, non-conforming, Federal Real estate Administrationinsured, U.S.

Department of Agricultureinsured. There are 2 parts to your home mortgage payment: principal and interest. Principal describes the loan amount. Interest is an extra quantity (calculated as a percentage of the principal) that lenders charge you for the benefit of borrowing money that you can repay over time. During your home loan term, you pay in regular monthly installments based on an amortization schedule set by your lender.

What Happened To Cashcall Mortgage's No Closing Cost Mortgages Things To Know Before You Get This

APR consists of the rates of interest and other loan costs. Not all home loan products are produced equal. Some have more stringent standards than others. Some lenders might require a 20% deposit, while others need as low as 3% of the home's purchase cost. To certify for some kinds of loans, you need beautiful credit.

The U.S. government isn't a loan provider, but it does guarantee particular kinds of loans that meet rigid eligibility requirements for earnings, loan limitations, and geographic areas. Here's a rundown of numerous possible mortgage. Fannie Mae and Freddie Mac are two government-sponsored business that buy and sell many of the conventional home loans in the U.S.

Debtors with excellent credit, stable work and income histories, and the ability to make a 3% deposit can typically get approved for a conventional loan backed by Fannie Mae or Freddie Mac, 2 government-sponsored enterprises that purchase and sell most conventional home loans in the United States. To prevent needing personal mortgage insurance (PMI), customers usually need to make a 20% deposit.

Conforming loans are bound by maximum loan limits set by the federal government. These limits vary by geographic area. https://b3.zcubes.com/v.aspx?mid=5532685&title=a-biased-view-of-how-do-mortgages-work-when-you-move For 2020, the Federal Real estate Finance Company set the standard adhering loan limitation at $510,400 for one-unit residential or commercial properties. Nevertheless, the FHFA sets a greater maximum loan limitation in specific parts of the nation (for example, in New York City or San Francisco).

The conforming home loan limitation for a one-unit property in 2020. Non-conforming loans typically can't be sold or purchased by Fannie Mae and Freddie Mac, due to the loan amount or underwriting guidelines. Jumbo loans are the most typical type of non-conforming loans. They're called "jumbo" because the loan quantities generally go beyond conforming loan limits.

The smart Trick of How Do Reverse Mortgages Work In Utah That Nobody is Discussing

Low-to-moderate-income purchasers purchasing a house for the very first time usually turn to loans guaranteed by the Federal Housing Administration (FHA) when they can't get approved for a standard loan. Borrowers can put down as bit as 3.5% of the home's purchase price. FHA loans have more-relaxed credit-score requirements than conventional loans.

One drawback of FHA loans: All customers pay an upfront and yearly home mortgage insurance coverage premium (MIP)a type of mortgage insurance coverage that secures the lending institution from borrower defaultfor the loan's lifetime. FHA loans are best for low-to-moderateincome borrowers who can't receive a conventional loan item or anybody who can not manage a significant down payment.

The U.S. Department of Veterans Affairs guarantees home loans for competent service members that require no down payment. The U.S. Department of Veterans Affairs ensures property buyer loans for qualified military service members, veterans, and their spouses. Borrowers can finance 100% of the loan quantity with no required deposit. Other advantages consist of a cap on closing expenses (which may be paid by the seller), no broker costs, and no MIP.

The funding cost varies depending upon your military service classification and loan amount. The following service members do not have to pay the financing fee: Veterans getting VA benefits for a service-related disabilityVeterans who would be entitled to VA payment for a service-related special needs if they didn't receive retirement or active service paySurviving spouses of veterans who passed away in service or from a service-related impairment VA loans are best for qualified active military personnel or veterans and their partners who desire extremely competitive terms and a home mortgage item customized to their financial needs.

Department of Farming warranties loans to help make homeownership possible for low-income purchasers in backwoods across the country. These loans require little to no money down for certified borrowersas long as properties satisfy the USDA's eligibility guidelines. USDA loans are best for homebuyers in qualified backwoods timeshare trap who have lower earnings, little money conserved for a down payment, and can't otherwise certify for a conventional loan product.

Not known Facts About How Much Are The Mortgages Of The Sister.wives

Home mortgage terms, including the length of payment, are an essential consider how a loan provider rates your loan and your interest rate. Fixed-rate loans are what they seem like: a set rates of interest for the life of the loan, typically from 10 to 30 years. If you wish to settle your house faster and can manage a higher regular monthly payment, a shorter-term fixed-rate loan (say 15 or twenty years) assists you shave off time and interest payments.

Choosing for a much shorter fixed-term home loan means regular monthly payments will be higher than with a longer-term loan. Crunch the numbers to ensure your budget plan can handle the higher payments. You might likewise wish to consider other goals, such as saving for retirement or an emergency fund. Fixed-rate loans are perfect for buyers who prepare to stay put for lots of years.

Nevertheless, if you have the cravings for a little danger and the resources and discipline to pay your home mortgage off much faster, a 15-year set loan can save you considerably on interest and cut your repayment duration in half - what kind of people default on mortgages. Adjustable-rate home loans are riskier than fixed-rate ones but can make good sense if you plan to offer your home or re-finance the home mortgage in the near term.

These loans can be risky if you're unable to pay a greater monthly home mortgage payment once the rate resets. Some ARM items have a rate cap defining that your monthly home loan payment can not go beyond a specific quantity. If so, crunch the numbers to make sure that you can possibly deal with any payment increases as much as that point.

The Only Guide to How Do Variable Apr Work In A Mortgages

There are different types of flexible mortgage an offset home mortgage (see below) is one. A method to utilize your savings to decrease the quantity of interest you pay on your mortgage. You need to turn your mortgage into a balanced out home loan, then open an existing or cost savings account with your home loan lender and link that account and your home loan up.

With a balanced out home mortgage you just require to pay interest on (100,000 10,000 =-RRB- 90,000 of your home mortgage. Whether you're looking for a quick concept of just how much you might borrow, or you desire totally free, fast, thorough advice, our specialists can help.

Unless you can purchase your house totally in money, finding the right residential or commercial property is just half the fight. The other half is picking the finest type of home mortgage. You'll likely be repaying your home mortgage over a long duration of time, so it is very important to find a loan that fulfills your requirements and budget.

The two primary parts of a mortgage are primary, which is the loan amount, and the interest charged on that principal. The U.S. government does not operate as a mortgage lending institution, but it does ensure certain kinds of mortgage. The 6 main types of home loans are conventional, adhering, non-conforming, Federal Housing Administrationinsured, U.S.

Department of Agricultureinsured. There are two parts to your home mortgage payment: principal and interest. Principal describes the loan quantity. Interest is an extra quantity (calculated as a percentage of the principal) that lending institutions charge you for the privilege of obtaining money that you can repay with time. Throughout your home loan term, you pay in month-to-month installations based upon an amortization schedule set by your loan provider.

Getting The Which Congress Was Responsible For Deregulating Bank Mortgages To Work

APR consists of the rates of interest and other loan charges. Not all mortgage items are developed equivalent. Some have more stringent standards than others. Some loan providers may require a 20% deposit, while others need as low as 3% of the house's purchase price. To get approved for some types of loans, you need beautiful credit.

The U.S. government isn't a loan provider, however it does guarantee certain types of loans that meet strict eligibility requirements for earnings, loan limitations, and geographical areas. Here's a rundown of various possible home loan. Fannie Mae and Freddie Mac are 2 government-sponsored business that buy and offer many of the conventional home mortgages in the U.S.

Customers with good credit, steady work and earnings histories, and the capability to make a 3% deposit can generally get approved for a conventional loan backed by Fannie timeshare trap Mae or Freddie Mac, two government-sponsored business that purchase and offer most traditional home mortgages in the United States. To avoid needing personal mortgage insurance coverage (PMI), customers normally require to make a 20% deposit.

Adhering loans are bound by maximum loan limits set by the federal government. These limitations differ by geographic area. For 2020, the Federal Real estate Finance Agency set the standard adhering loan limitation at $510,400 for one-unit residential or commercial properties. Nevertheless, the FHFA sets a greater maximum loan limitation in particular parts of the nation (for example, in New york city City or San Francisco).

The conforming mortgage limit for a one-unit residential or commercial property in 2020. Non-conforming loans generally can't be offered or purchased by Fannie Mae and Freddie Mac, due to the loan amount or underwriting standards. Jumbo loans are the most typical kind of non-conforming loans. They're called "jumbo" because the loan amounts normally go beyond adhering loan limitations.

The Only Guide to How To Switch Mortgages While Being

Low-to-moderate-income buyers buying a home for the very first time typically rely on loans insured by the Federal Real Estate Administration (FHA) when they can't qualify for a traditional loan. Borrowers can put down as little bit as 3.5% of the house's purchase rate. FHA loans have more-relaxed credit-score requirements than standard loans.

One downside of FHA loans: All debtors pay an in advance and yearly home loan insurance coverage premium (MIP)a type of home loan insurance coverage that safeguards the lending institution from borrower defaultfor the loan's lifetime. FHA loans are best for low-to-moderateincome borrowers who can't receive a standard loan product or anybody who can not pay for a substantial deposit.

The U.S. Department of Veterans Affairs ensures home mortgages for certified service members that require no deposit. The U.S. Department of Veterans Affairs guarantees property buyer loans for certified military service members, veterans, and their partners. Debtors can finance 100% of the loan quantity with no needed deposit. Other benefits consist of a cap on closing expenses (which might be paid by the seller), no broker charges, and no MIP.

The funding cost varies depending on your military service category and loan amount. The following service members do not have to pay the financing fee: Veterans getting VA advantages for a service-related disabilityVeterans who would be entitled to VA compensation for a service-related special needs if they didn't receive retirement or active duty paySurviving spouses of veterans who died in service or from a service-related disability VA wellesley finance loans are best for qualified active military workers or veterans and their spouses who desire highly competitive terms and a home mortgage product customized to their financial needs.

Department of Farming assurances loans to help make homeownership possible for low-income purchasers in backwoods nationwide. These loans need little to no cash down for qualified borrowersas long as properties fulfill the USDA's eligibility rules. USDA loans are best for homebuyers in qualified rural areas who have lower earnings, little money conserved for a deposit, and can't otherwise receive a conventional loan item.

Things about After My Second Mortgages 6 Month Grace Period Then What

Mortgage terms, consisting of the length of repayment, are a crucial consider how a lending institution prices your loan and your interest rate. Fixed-rate loans are what they sound like: a set rate of interest for the life of the loan, normally from 10 to 30 years. If you desire to settle your house quicker and can pay for a greater monthly payment, a shorter-term fixed-rate loan (state 15 or twenty years) helps you slash off time and interest payments.

Selecting a much shorter fixed-term home loan means monthly payments will be greater than with a longer-term loan. Crunch the numbers to guarantee your budget can deal with the greater payments. You may likewise wish to consider other objectives, such as conserving for retirement or an emergency situation fund. Fixed-rate loans are ideal for buyers who prepare to stay put for several years.

Nevertheless, if you have the cravings for a little danger and the resources and discipline to pay your mortgage off much faster, a 15-year fixed loan can conserve you considerably on interest and cut your repayment period in half - how does bank know you have mutiple fha mortgages. Variable-rate mortgages are riskier than fixed-rate ones but can make https://b3.zcubes.com/v.aspx?mid=5532685&title=a-biased-view-of-how-do-mortgages-work-when-you-move sense if you plan to sell your home or refinance the mortgage in the near term.

These loans can be risky if you're not able to pay a higher monthly home loan payment once the rate resets. Some ARM products have a rate cap specifying that your regular monthly home mortgage payment can not exceed a specific quantity. If so, crunch the numbers to guarantee that you can potentially manage any payment increases approximately that point.

3 Easy Facts About How Do Reverse Mortgages Work When Someone Dies Explained

Experian keeps in mind that many lending institutions desire ratings 720 or greater and will not consider debtors with scores lower than 600. Jumbo loans have higher deposit requirements than conventional home loans, usually in the 20% to 30% variety. Lenders also like to see greater money reserves for jumbo loan customers and debt-to-income ratios at a maximum of 36%.

Higher lending limitations to widen your purchase options Rate of interest that are competitive with adhering conventional loans Can help buy more expensive homes in areas not designated as high-cost locations by the FHFA Higher asset requirements than conventional adhering home loans Stricter qualifications than conforming traditional home mortgages and government-backed loans You have substantial funds for a deposit and a high credit history Your house purchase rate is higher than $510,400 in the majority of areas, or $765,600 in some high-cost regions Government-insured home mortgages are numerous in the market.

These loans make homeownership available to a broad range of low- to mid-income buyers, consisting of first-time purchasers, since of their versatile certification and deposit requirements. We highlight four various type of government-insured home loans listed below. FHA loans are ensured by the Federal Housing Administration and have credentials requirements that unlock for a range of customers.

Unknown Facts About What Are The Interest Rates On 30 Year Mortgages Today

Borrowers with a minimum 580 credit history receive the most affordable down payment: 3.5% of the purchase cost. If your credit history is a bit lower (in 500-579 variety), you'll require to bump your deposit approximately 10%. There's a maximum debt-to-income ratio of 43% for all customers, and these mortgages need to fund a debtor's primary residence.

Versatility on credit history and deposit Down payments as low as 3.5% Can only be used for main homes Low deposits need PMI You can only manage a little down payment You have credit bumps in your past however a present excellent pay history Backed by the U.S.

While it may appear to be only for farmland on the surface, USDA loans can purchase main homes for qualified applicants. Borrowers aiming to purchase a house in locations designated as qualified by the USDA need to meet rigorous income limits. These limitations are specific to the region where you're buying a home.

See This Report on How Many Mortgages Are Backed By The Us Government

USDA loans are offered from a broad variety of local and online lenders and, in many cases, directly from the USDA itself for some low-income candidates. The USDA does not set minimum credit rating guidelines. Borrowers with a rating of 640 or higher are stated to experience a more structured loan procedure.

No minimum credit history to certify Targeted for low- to mid-income families in rural locations Earnings Click here and geographical limitations Will usually include PMI, which contributes to the regular monthly home mortgage payment You're a lower-income buyer interested in buying a home in a competent location. You have a credit report that makes receiving other home mortgages hard.

Army, or a relative of one, you may receive a mortgage backed by the Department of Veterans Affairs (why is mortgage insurance required for reverse mortgages). There's no limit on how much you can borrow, but there are limitations to how much of the loan the VA will guaranteeand that figures out whether you'll have to make a deposit.

Some Ideas on When Will Student Debt Pass Mortgages You Should Know

Houses acquired using VA loans need to be a primary residence for the service member or partner. who does stated income mortgages in nc. Active-duty personnel can utilize a VA loan to buy a house for a reliant. To get a VA loan, certified applicants can check out a wide range of local or online lenders. Anybody requesting a VA loan will have to present a Certificate of Eligibility, or COE.

There, you can explore the treatments, just how much you can borrow and a distinct detail was angel from hell cancelled called "privileges" just how much of the loan the Department of Veterans Affairs will guarantee. Versatile credit credentials No deposit in a lot of cases and no PMI requirements Minimal to active service, veterans and qualifying family members of the U.S.

military You're trying to find a low deposit without needing to pay PMI If you've got your eye on a fixer-upper home, it's worth taking a look at a 203( k) loan, ensured by the FHA. A 203( k) loan lets you take out one loan to cover the purchase of the house and the improvements you require to make.

The 10-Second Trick For What Beyoncé And These Billionaires Have In Common: Massive Mortgages